Bond valuation includes calculating the present value of the bond s future interest payments also.

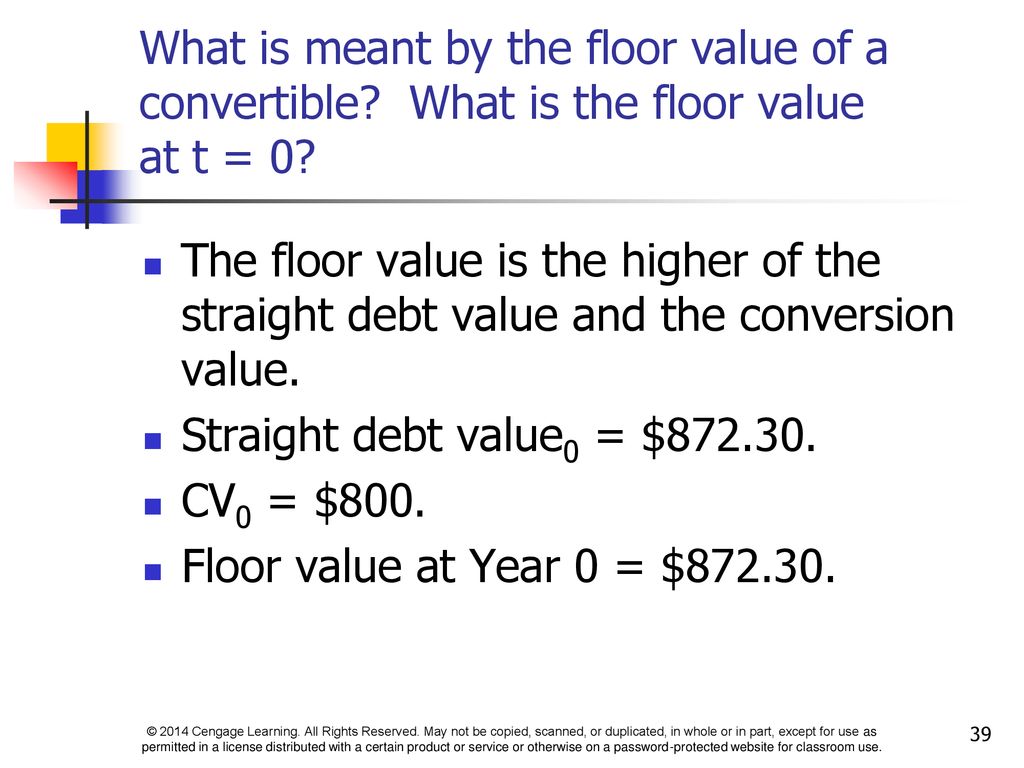

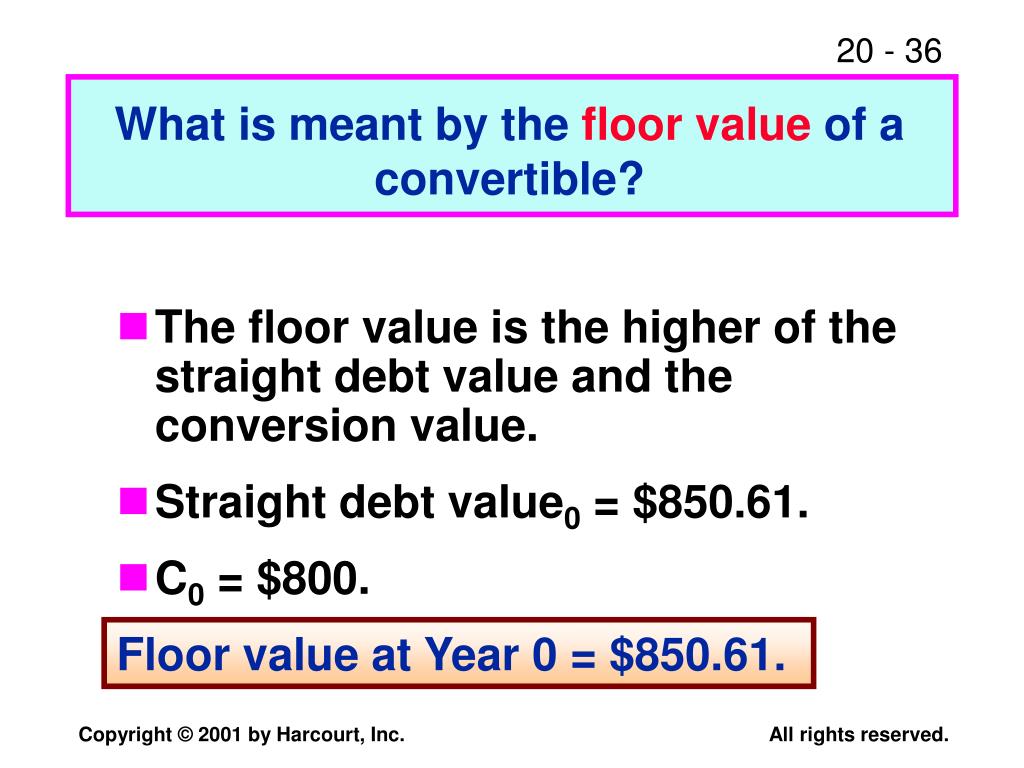

The theoretical floor value for a convertible bond is its.

It is convertible into 15 shares of common stock that presently sell for 50 per share.

2 the theoretical floor value for a convertible bond is its choose one answer.

The bond floor is the value at which the.

A convertible bond is currently selling for 970.

Conversion value equals the pure bond value.

In order to calculate basic earnings per share the earnings after taxes have to be adjusted for the elimination of the convertible bond interest expense.

It is convertible into 15 common shares which presently sell for 50 per share.

The theoretical floor value for a convertible bond is its a.

The conversion premium is the greatest and the downside risk the smallest when the.

The lowest value that convertible bonds can fall to given the present value of the remaining future cash flows and principal repayment.

A 51 67 b 50 00 c 60 00 d 5 00.

The value of these payments represents a convertible bond s floor or minimum value.

Bond valuation is a technique for determining the theoretical fair value of a particular bond.

The conversion premium is 5.

The theoretical floor value for a convertible bond is its.

The theoretical floor value for a convertible bond is its.

Question 7 of 20.

True false question 30 marks.

Pure bond value.

D pure bond value.

Downside protection is ineffectual if the bond is bought at a large premium over floor value interest rates on the debt instrument part of a convertible bond are frequently below market interest rates.

Conversion value is greater than the pure bond value.

The conversion value represents the value of the common stock into which the bond can be converted.

A convertible bond is currently selling for 855.

The theoretical floor value for a convertible bond is its.

The minimum theoretical value of a warrant to buy 6 shares of a firm s stock at 50 per share is 10 what is the current market price of the firm s stock.

This represents the security s floor value or the minimum price at which it should trade as a nonconvertible bond.

It should trade for at least its floor value regardless of how low the stock drops.